Neluns

- New Generation Financial Ecosystem

Neluns is the

innovative financial ecosystem, combining within itself a bank that can work

with fiat and cryptocurrencies, as well as a cryptocurrency exchange and

insurance company, creating the best conditions for the quality development of

the cryptocurrency market, inflow of new participants and capital.

What Will Be Available To Users in The Neluns Ecosystem :

- The purchase and sale of cryptocurrency

are just a few clicks away.

- The leadership of cryptocurrency

transactions started on the exchange.

- Depositing and also with drawing funds

through the system is quite a few clicks through all sides of World.

- IBAN account opening – personal account as

well as multicurrency office.

- The discharge of Visa, MasterCard and

American Express debit and credit cards.

- Direct shipping as well as international

money transfer receipts.

- Storage of assets to Neluns deposits in

fiat currency and cryptocurrency.

- Neluns loan receipts to fiat and also

cryptocurrency.

- Profit receipts, through the lending of

assets from the Peer-to-Peer Loan Platform (P2P).

- Ensuring in every trading transaction.

- Take your profits through NLS token

trading transactions on the cryptocurrency exchange.

- Dividend receipts.

- Active traders can develop profits and

also reduce risk levels.

Neluns Vsers Benefit The Following Under The Ecosystem :

- Innovative technologies ensure a

hassle-free and quick trading of cryptocurrencies despite the peak loads.

- Under the protection of the “Bank

Guarantee” principle users can actively participate in trading of

cryptocurrencies. “Bank Guarantee” principle in conjunction with leading

technologies allows you to easy withdraw your funds. It also provides a

high level of protection from cyber-attacks and creates perfect conditions

for cryptocurrency traders and fiat funds. Users can make withdrawals from

around the globe under the guard of the Federal Deposit Insurance

Corporation (FDIC).

- Users get access to four types of debit or

credit cards. These are: Lite, Silver, Gold, and Platinum.

- Users can access loans in fiat or

cryptocurrency in the Neluns banking system.

- Gain profits while lending funds on a P2P

(peer-2-peer) Lending platform. The lending platform will function at the

base of Neluns Bank and authorized users will be able to use this service.

- Active users get higher protection and

other additional benefits.

- Users can receive profits from trading NLS

tokens and dividends from all insured trades.

- Users get a chance to open a private or

corporate multicurrency IBAN account.

- Besides, making purchases, sending

payments, trading cryptocurrencies and fund withdrawals are available from

any ATM around the globe 24 hours 7 days a week. All users are able to

carry out transactions in USD, EUR, GBR as well as cryptocurrencies.

- A bank card will automatically accompany

the multicurrency IBAN account.

- The solace of the client is principal to

the group and to enhance clients’ involvement, four kinds of programming

items have been produced. A 24-hour client benefit support will be

accessible to answer questions and rapidly fathom every one of clients’

issues. A portable application for iOS and Android gadgets has been

produced to make keeping money and trade tasks simple and accessible all

day and all night.

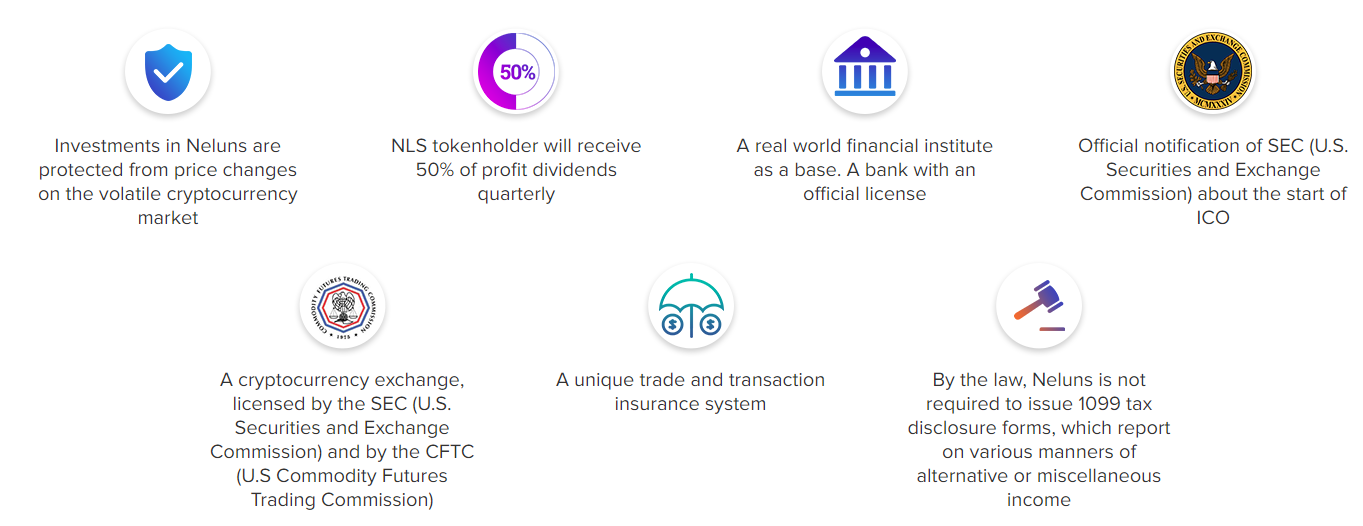

Advantages:

NLS token holders receive 50% profit.

Additional bonuses and discounts with platform.

The price of an NLS token will reach $ 1,200 by 2021.

Tokens are released only during the ICO

Tokens are listed on Bancin, Yobit, HITbtc, Huobi, Bittrex, Poloniex, and

so on

Expected NLS price

Economic business process modeling allowed us to forecast the NLS token

price in the short, medium and long term:

Legal aspects

Registration of Neluns Bank will be in England.

The registration of Neluns Exchange and Neluns Insurance takes place in the

USA.

The activities of the financial system of Neluns will meet the following

requirements and recommendations:

- The Bank of England (the British Central Bank)

- FCA (Financial Supervisory Authority)

- PRD (Prudential Regulation Authority)

- FSA (Financial Services Authority)

- FATF (Financial Action Task Force on Money Laundering)

- Basel III agreement

- PSD2 guidelines

- CFTC (U.S. Commodity Futures Trading Commission)

- SEC (US Securities and Exchange Commission)

Neluns goal

The goal of Neluns is to create a gateway connecting the cryptocurrency

market with the traditional financial market by creating an innovative

financial ecosystem, and open access to cryptocurrencies for a broad ran ge of

individuals.

Token

Information

The tokens

which are created by the Neluns follows ERC20 standard used for security. They

will be providing the holders with approximately 50% dividends and it will be

depending on the Neluns ecosystem which includes Neluns Bank, Neluns Exchange,

Neluns Insurance profits. All the dividends will be reached out in quarters to

the holders in accordance with the number of tokens the user hold compared to

the total.

Token: NLS

Platform: Ethereum

Type: ERC20

Country: USA

Accepting: ETH

Price in

ICO: 1 NLS = 1 USD

Soft

Cap: 10,000,000 USD

Roadmap

November

2017: Team Neluns Formulation

December

2017: ICO preparation

May

2018: Beta testing of the iOS mobile application

June

2018: Holds a closed investment round for investment funds and anchor investors

July

2018: Preparation for the sale of NLS tokens

August

2018: Pre-sale of NLS tokens, pre-ICO

September

2018: NLS ICO tokens, mobile app launch (beta version) for iOS and Android

October

2018: Listing on currency exchange bittrex.com, huobi.com, kraken.com

November

2018: Launch of the P2P loan platform, launch of the mobile application (alpha

version) for iOS and Android

December

2018: Listing on hitbtc.com, poloniex.com cryptocurrency exchange, binance.com,

bitfinex.com, okex.com

January

2019: Obtain licenses for Bank Neluns, launch payment services to convert

cryptocurrency and carry out fund transfers to any part of the world,

connecting Bank Neluns to Swift, starting from Visa, MasterCard, American

Express credit cards issued

February

2019: Obtain a CFTC license and launch the Neluns Exchange - an innovative

cryptocurrency exchange

April

2019: Launch of the full Neluns ecosystem

April

2020: IPO (initial public offering) on the New York Stock Exchange (NYSE)

For more information :

Author :

Buk Man

0x54397f621506F0f982e197fFEbBb67dD8A44ce06

No comments:

Post a Comment